News Keep an eye on inflation

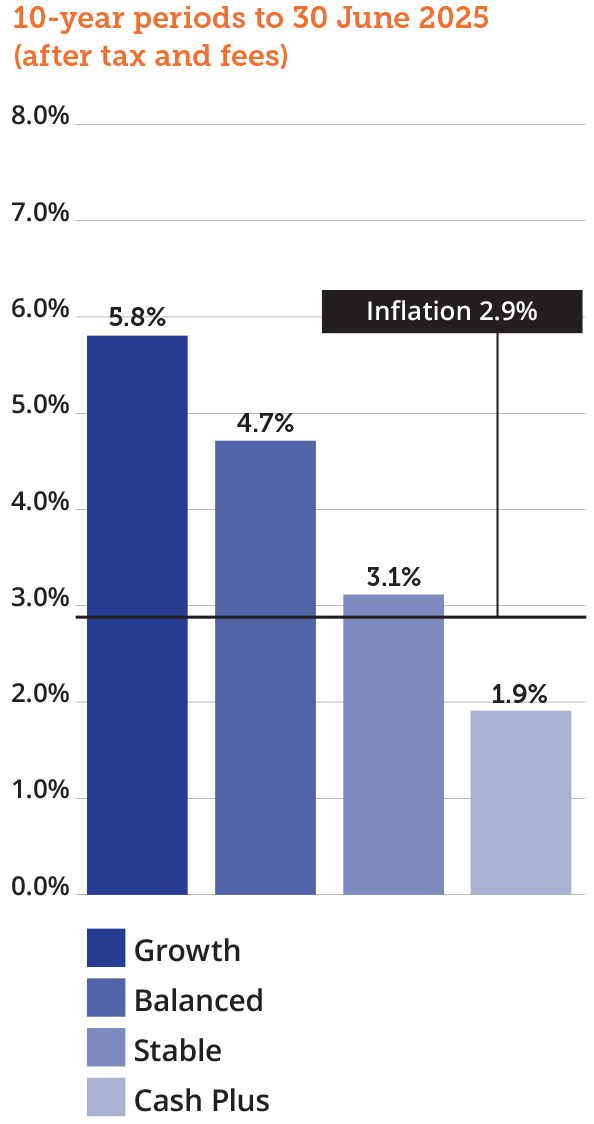

It may be tempting to head for the hills during times of market volatility and switch to an investment option that is more likely to provide steady, consistent returns. This may be a good strategy if you’re saving to meet a more immediate financial goal. Over the long term though, you must be mindful that inflation has the potential to erode the spending power of your savings. This graph shows average PSS returns over 10 years against inflation over the same period. You’ll see returns for Stable have only just kept pace with inflation and returns from Cash Plus are well behind. The difference between the nominal return shown here and the rate of inflation is called the real return. For example, the real return for Growth over the past 10 years is 2.9% (5.8 minus 2.9).