2025 investment commentary

Overview of investment markets for the year ended 31 March 2025 from our investment manager, Mercer. All returns in the following commentary are in local currency terms, unless stated otherwise.

Market summary

Investment markets navigated significant volatility and transformation, influenced by economic trends, geopolitical events, and shifting monetary policies during the year ended 31 March 2025.

The year began with positive economic momentum as equity markets continued to experience growth, despite concerns about resurgent inflation and an overheating US economy. As inflation fears subsided, major asset classes generally posted favorable returns with large-cap developed market equities leading the way.1 Midway through the year, a notable shift occurred as central banks across the world began their rate cutting cycles. This prompted a “great rotation” in equity investments towards sectors such as small companies and ‘value’ – companies expected to perform in an environment with lower interest rates and softer economic growth. This period also saw strong performance in fixed income markets, as government bonds and emerging market debt all delivered impressive returns amid expectations of further rate cuts.

The US presidential elections in the latter part of 2024 saw US equities rally on the prospect of a supportive business environment as Donald Trump’s victory looked increasingly likely, and US government bond prices fall as concerns of government spending mounted. This optimism proved to be short lived, as by December, caution returned as potential tariffs and the Federal Reserve's conservative approach to interest rates dampened market enthusiasm. Geopolitical tensions, including conflicts in Ukraine and the Middle East, further complicated the landscape. As 2025 commenced, the US stock market faced significant corrections with the S&P 500 experiencing a notable decline amid rising trade policy uncertainty and global tensions, while news of China’s cost-efficient AI model DeepSeek undermined US AI-related stock valuations. In contrast, international markets showed resilience, bolstered by fiscal stimulus, increased defence spending, and a weakening US dollar.

In New Zealand, economic activity was sluggish with the economy falling into a technical recession. The Reserve Bank of New Zealand (RBNZ) looked to move quickly, cutting the Official Cash Rate by 25bps in August, followed by a 50bps ‘double cut’ in October. As inflation has fallen back towards its target range of 1% - 3% per annum, this has provided the RBNZ with comfort to cut the OCR further to support the New Zealand economy. As at 31 March 2025, the OCR sat at 3.75%. By March 2025, data indicated a 0.7% rise in economic activity for Q4 2024, driven by sectors such as rental, hiring, and tourism, signaling a rebound from a technical recession.

Sector commentaries

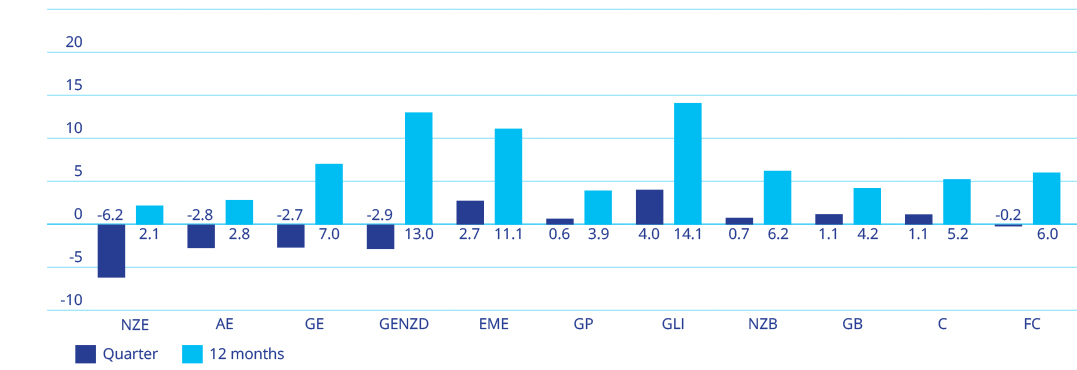

This chart shows the returns of various market indices for periods ending 30 September 2024. Key: NZE New Zealand equities; AE Australian equities; GE Global equities (local currency); GENZD Global equities (NZ dollars); EME Emerging market equities local currency; GP Global property hedged; GLI Global listed infrastructure; NZB New Zealand bonds; GB Global bonds aggregate hedged; C New Zealand cash; FC Foreign currency effect. The foreign currency effect is the difference between the unhedged and hedged overseas share returns.

Trans-Tasman equities

There was mixed performance in Trans-Tasman equities during the year as persistent inflation, monetary policy easing and a brief technical recession in New Zealand all made impacts. Both markets produced positive returns with the S&P/ASX 200 Index returning 3.7% for the year ended 31 March 2025 and 2.1% for the S&P/NZX50 Index.2 The RBNZ embarked on its rate cutting cycle in August 2024, having a positive impact on rate-sensitive New Zealand equities. The Australian materials sector benefitted from an expectation of increased demand following a stimulus package announced by China in late-September. However, the first quarter of 2025 brought substantial declines to both markets as they followed their global counterparts and reacted to global trends and tariff concerns.

Global equities

Global developed market equities (represented by the MSCI World Index in local currency) returned 7.0% during the year, substantially driven by US mega-cap technology companies related to artificial intelligence.3 However, UK equities (MSCI UK Index) quietly outperformed other regions, returning 12.0% for the year to 31 March 2025. In Europe, markets struggled through a year of political uncertainty, particularly in France and Germany which saw hotly contested elections. However, lower interest rates attracted investors and helped the MSCI Europe Index produce positive returns of 5.7%. Emerging markets outperformed developed markets, delivering a return of 11.1%, bolstered by supportive measures for real estate sector in China and strong performance in Taiwan as semi-conductor companies were pushed higher alongside the US mega-cap companies. November 2024 marked the best month for global stock markets in over two years, coinciding with Donald Trump’s decisive victory in the US presidential election and positive economic data from October being released. However, Q1 2025 saw significant declines for global stock markets. This was primarily driven by US stocks in response to the DeepSeek launch in January and increasing trade uncertainty, rising concerns about weaker growth and higher inflation expectations.

Property and listed infrastructure

Throughout the year, expectations for the future path of monetary policy were continuously changing. This posed significant challenges for the interest rate-sensitive real assets sector. Global real estate investment trusts finished the year ended 31 March 2025, up 3.9% (NZD hedged), having faced downswings in rate expectations throughout the period.4 Conversely, listed infrastructure showed resilience, returning 14.1% (NZD hedged) amid a positive outlook supported by Germany's €500bn infrastructure spending proposal, which spiked borrowing costs across the Eurozone. Overall, while the industrial sector bolstered returns, the office space lagged, highlighting a mixed performance landscape in real estate and infrastructure.

NZ bonds and cash

New Zealand bonds delivered a return of 6.2% (Bloomberg NZ Bond Composite 0+ Yr Index), outperforming New Zealand equities for the year. This was supported by the 4 consecutive rate cuts served up by the RBNZ, reducing the Official Cash Rate (OCR) from 5.5% to 3.75% during the year. The 10-year government bond yield declined by 3bps to 4.56% while cash generated an impressive 5.2% return for the year. The escalating global trade war is causing volatility locally and prompting investors to pivot to safe-haven assets.

Global bonds

Global bonds (as measured by the Bloomberg Global Aggregate Bonds Index NZD Hedged) posted strong returns of 4.2% for the year. Labour market conditions and favourable inflation news shifted the market dynamics positively. Central banks, including the European Central Bank and Bank of Canada, began cutting rates in Q2 2024. The US Federal Reserve and Bank of England held off until Q3, both adopting a more cautious approach to monetary policy easing measures due to strong wage growth in the UK and uncertainty in US markets leading up to the US presidential election. Government bonds ended the year in positive territory, up 2.7%, but performance was mixed in Q1 2025. Recession risks contributed to a 2.9% return from US Treasuries, while European sovereign bonds struggled due to expectations of significantly higher issuance to fund new government spending.

1Large cap companies are those with a large market capitalisation, generally more than $10 billion. These companies are typically established, industry leaders with global presence.

2An index is a ‘basket’ of securities, the changes in value of which are designed to represent the movements of a particular market or market sector. An example is the Morgan Stanley Capital International World Index (MSCI World) for international equities.

3Mega cap refers to the largest publicly traded companies, typically those with a market capitalisation exceeding $200 billion.

4Currency hedging is a tool used to remove the potential loss arising from movements in foreign exchange rates. When overseas investments are hedged, returns are broadly in line with the underlying market or local currency return.

This information has been prepared by Mercer (N.Z.) Limited (Mercer) for general information only. The information does not take into account your personal objectives, financial situation or needs. Before making any investment decision, you should take financial advice as to whether your intended action is appropriate in light of your particular investment needs, objectives and financial circumstances. Neither Mercer nor any related party accepts any responsibility for any inaccuracy. Past performance is no guarantee or indicator of future performance.