Missing the best days in the market

“It’s time in the market, not timing the market, that matters.”

The volatility in share prices experienced this year is not unusual by historical standards. For example, in March 2020, share prices as measured by the S&P 500 index jumped by as much as 9.38% in a single day and fell as much as 11.98%. Given the recent market volatility, we think it’s worth illustrating the danger of trying to time the market either by moving to a more conservative or higher-risk option. It is wiser to make a choice based on your long-term goals and stay the course.

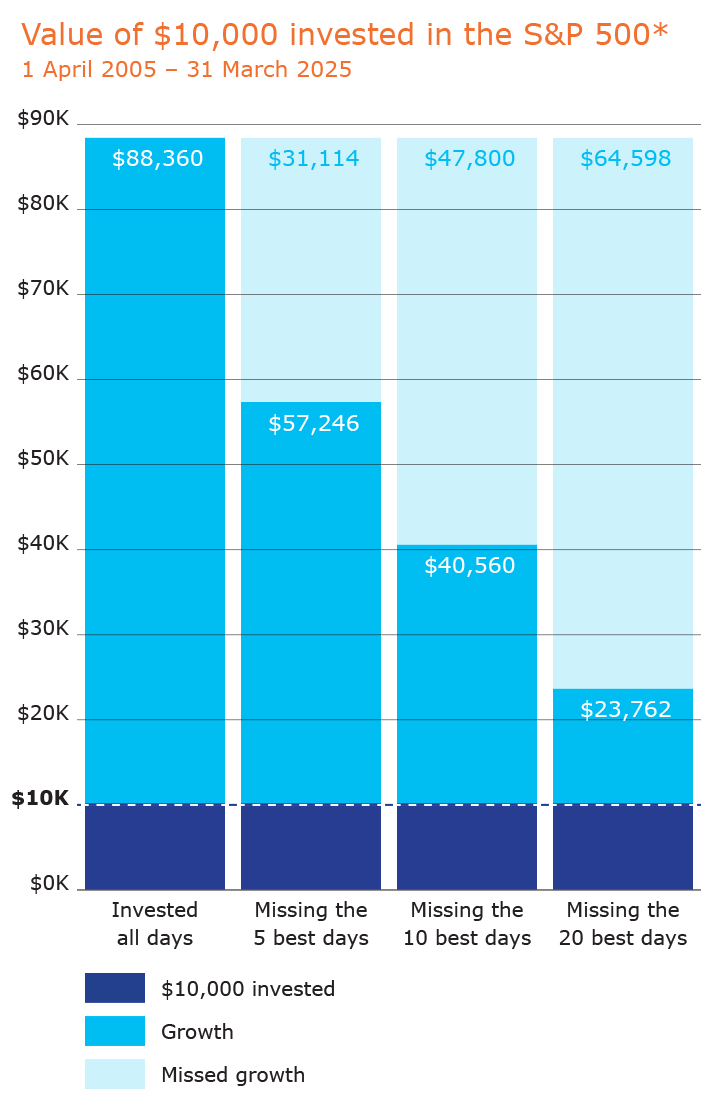

Sharemarkets move in broad cycles – sometimes referred to as bull and bear markets. A bull market is one in which share prices are generally rising and investors are optimistic. Share prices are generally falling in a bear market and investor sentiment turns negative. The trouble is that it’s very difficult to predict when these cycles will begin and end. Also, prices still go up and down within those (longer) cycles. Even missing good days in bear markets can be costly in terms of long-term returns. This graph shows the impact of being out of the market on the best days over the 20 years ending 31 March 2025 based on an initial investment of $10,000.

*The S&P 500 is an index that measures the change in value of the 500 largest companies listed on stock exchanges in the United States.

There is a potential silver lining when markets fall, especially for younger members, provided you continue making regular contributions. The money you invest in the scheme buys you a number of units. These units go up and down with markets and the price changes daily. The lower the unit price, the more units you will get for your money (just like buying shares). When markets fall, your contributions will buy more units than they would have prior to the fall.

The current volatility provides a good reminder of the need to review your investments as you age. As you near retirement, you have less time to allow markets to recover should they fall. Slowly and steadily switching your investments to lower risk options is one strategy to help cope with this (and is the basis for Super Steps, which does this for you).