Changes to Super Steps

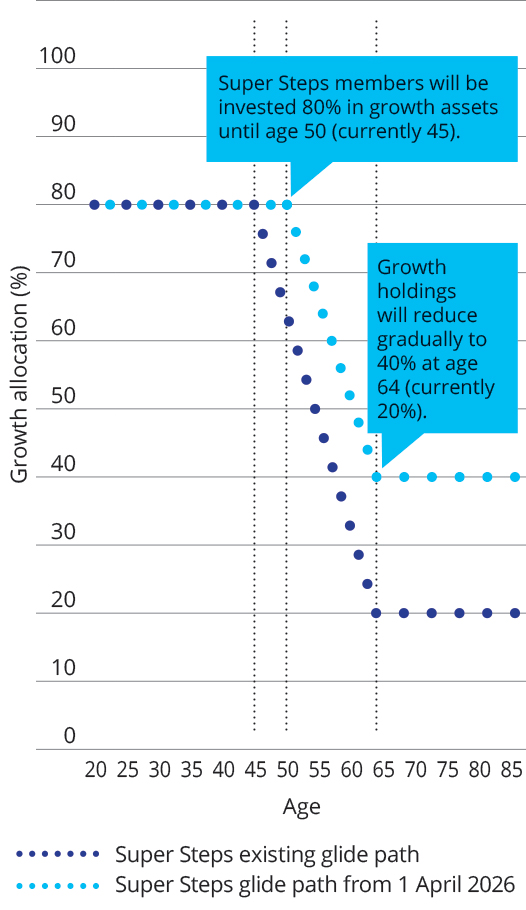

The Super Steps glide path will change from 1 April 2026. Under the new structure, Super Steps members will be invested 80% in growth assets for longer, reducing to 40% in growth assets at age 64. This graphic explains the changes.

Why the change?

Super Steps is the default investment option. It needs to strike a balance between risk and return – not too conservative and not too aggressive. With New Zealanders living and working longer, the directors feel the current settings are too conservative. The changes are intended to provide a strategy appropriate for a prudent but non-expert investor prepared to accept a moderate level of risk in order to improve the potential for long-term growth. In making these changes, we recognise that members can opt out of Super Steps at any time and construct an individually tailored strategy using combinations of the investment options if they wish.

A reminder about how Super Steps works

The underlying principle of Super Steps is to reduce your risk/return profile progressively over time. It is designed to move you from growth assets (which are riskier but likely to produce higher returns) towards income assets (in which volatility can be expected to be lower) as you get older. Super Steps uses Growth, Balanced and Stable as building blocks to achieve your investment mix at any given age. Changes are made on 1 April each year, not on your birthday or the anniversary of the date you joined the scheme.

What happens on 1 April 2026?

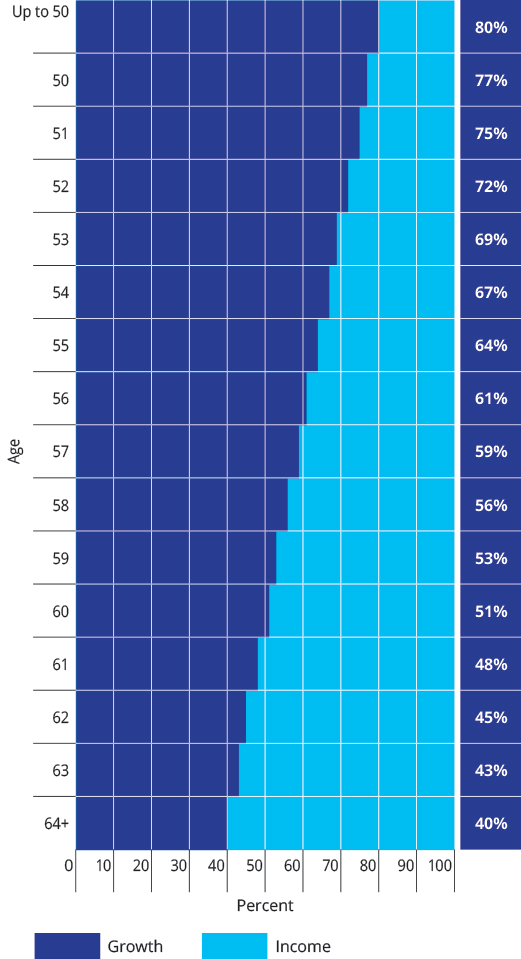

If you remain invested in Super Steps, your investment mix will change on 1 April 2026 as follows.

Age |

What to expect |

|---|---|

|

Under 45 |

Your savings will remain invested 80% in growth assets. |

|

45–49 |

Your investment mix will revert to 80% growth assets. |

|

50 and over |

Your exposure to growth assets will increase in line with the graphic below. |

This graphic shows the mix of growth and income assets by age from 1 April 2026.

If you want to opt out of Super Steps

You can change your investment strategy at any time if you no longer wish to be invested in Super Steps. Sign in to your account online or complete this form.

Talk to a Mercer adviser

Make a time to talk with someone from Mercer’s financial advice team if you would like help to make a decision. They can recommend an investment strategy based on your individual circumstances. We especially encourage older Super Steps members, who will see their investment mix shift significantly towards growth assets, to seek advice and make sure they are comfortable with the changes. Complete this form to arrange a call back from Mercer. There is no individual charge to you for this service.