Growth

Growth invests predominantly in growth assets (e.g. shares) with a smaller percentage in income assets (e.g. fixed interest).

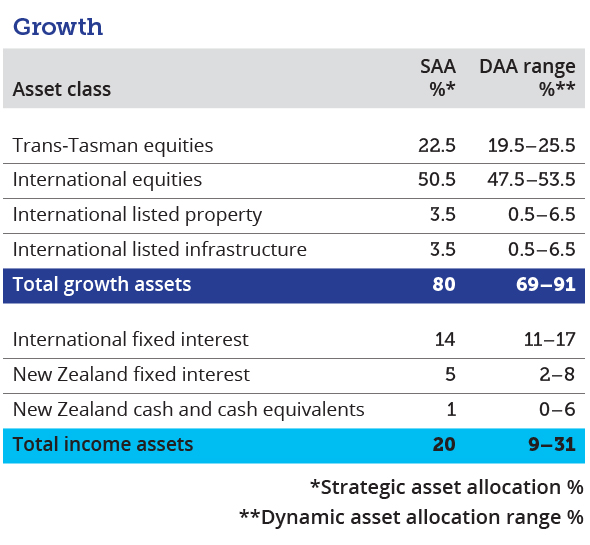

Target asset allocation

Investment expectation

To provide high-level returns with an associated relatively high level of risk. As a guide to members, Growth is expected to provide a long-term return after tax and investment expenses of 3% p.a. above the inflation rate, with the likelihood of a negative return approximately 1 year in every 4. Minimum suggested investment timeframe: 10 years.

Estimated fund charges

Estimated total annual fund charges (p.a. of net asset value).

0.38% p.a.

or $38 for every $10,000 invested

Historical returns

Information about asset classes held by Growth

Download the latest PDF fact sheet

Income assets

Growth assets

Trans-Tasman equities

Mercer Trans Tasman Shares (149 KB)

International equities - unhedged

International equities (150 KB)

International equities - hedged

International equities - hedged (150 KB)

International indexed equities - unhedged

International indexed equities (149 KB)

International indexed equities - hedged

International indexed equities - hedged (150 KB)

International equities - emerging markets

International equities – emerging markets (149 KB)

International listed property

Mercer Listed Property (199 KB)

International listed infrastructure

Mercer Listed Infrastructure (199 KB)