Investment options

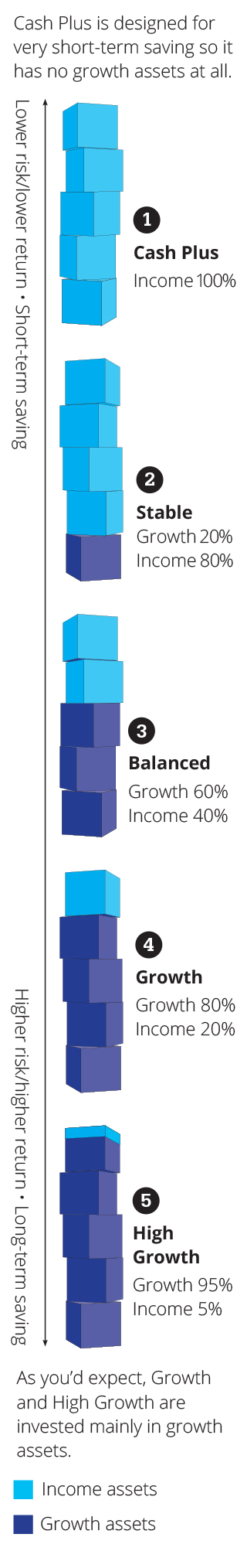

We offer six investment options. The first is a 'lifecycle' type option called Super Steps. With Super Steps, the mix of investments changes automatically based on your age. Each of the other five options (High Growth, Growth, Balanced, Stable and Cash Plus) has a different mix, largely split between growth and income assets.

Super Steps

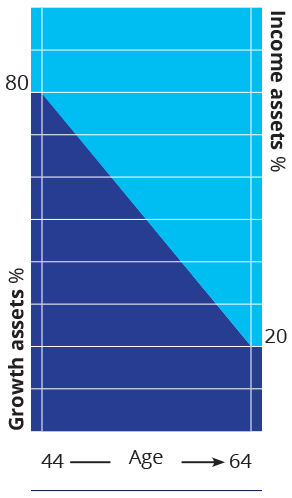

This is a ‘set and forget’ option. With Super Steps, the mix of growth and income assets changes automatically as you get older. Up until age 45, your savings are invested in 80% growth assets. From then, the percentage of growth assets is reduced gradually to 20% at age 64. Here’s how it works.

Super Steps uses three options – Growth, Balanced and Stable (see below) – to transition your savings from predominantly growth assets to predominantly income assets over time. With Super Steps, you will be automatically invested in Growth until the age of 45. Each year from the age of 45 to 50, the investment allocation will transition progressively and automatically from mainly Growth to mainly Balanced. Each year from the age of 51 to 64, the investment allocation will transition progressively and automatically from mainly Balanced to 100% Stable. See page 4 of the product disclosure statement for details of the transitions.

The investment mix changes on 1 April each year, not on your birthday or the anniversary of the date you joined the scheme. You cannot mix between Super Steps and the other five options. However, you can opt out of Super Steps whenever you choose. Super Steps is also the default investment option. We will invest your contributions in Super Steps if you don’t tell us how you would like your savings invested when you join the scheme.

Other investment options

If you prefer, you can build your own mix of growth and income assets by choosing one or a combination of five investment options. Each is made up of growth and income assets mixed in different amounts. The exception is Cash Plus which has no growth assets.

You can choose a different strategy for your existing account balances and for future contributions.

See pages below for detailed benchmark asset allocations for each option.

Choosing an option

The best investment strategy for you will depend on a number of factors. Think about how long you have before you move from making contributions to spending your savings. Also consider other factors such as any other savings you may have and your appetite for risk. All investments can produce negative returns from time to time. On the plus side, higher-risk investments such as shares tend to produce higher returns in the long term, but they also tend to experience greater volatility than other investment types. You need time to ride out the ups and downs – you want to minimise the possibility that you have to draw on your funds when the market is down. The closer you are to spending your savings, the more likely you are to prefer an option weighted towards lower-risk, less-volatile investments such as cash and bonds.

Use our risk profiler to help you better understand how your approach to risk translates to the investment options available to you.

If you are unsure about your decisions, we suggest you talk to someone from Mercer's financial advice team (see below). There is no charge for this service. Police Wellness Advisors and other Police or Police Association staff are not financial advisers and, therefore, they are not in a position to help other than to provide general information about the scheme.