Investment concepts

Balancing risk and return

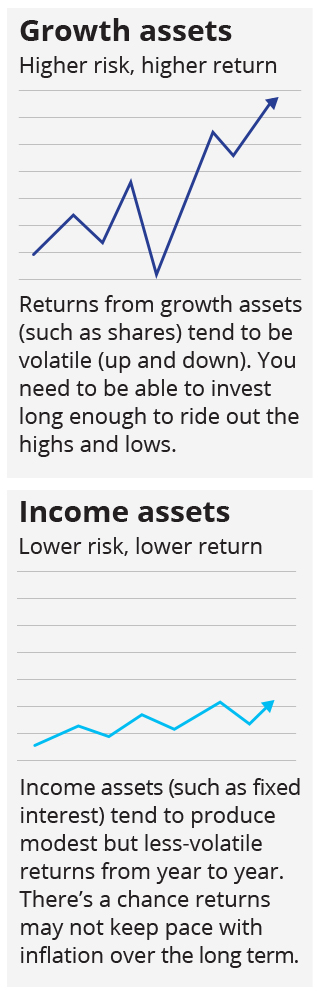

We have a range of investment options for you to choose from, each offering a different mix of the same ingredients. Those ingredients are growth assets and income assets. Growth assets are best suited to long-term saving. Income assets are best suited to short-term saving. Here’s why.

Investment risk

All investments involve an element of risk. Risk can be described as the uncertainties both for loss and growth that may affect the value of an investment. Some of the things that may cause a fund’s value to move up and down are market risk, investment return risk, currency risk and liquidity risk.

Market risk |

From time to time, market conditions will materially and adversely affect the scheme’s investments. Risks related to market conditions include movements in the general price level of an investment, changes in demand and supply in the market or sectors in which an investment is made and changes in political, economic and regulatory conditions. |

Investment return risk |

Investment assets offering the highest expected long-term returns also carry with them the highest risk. Those investment options in the scheme that have more growth assets (such as shares) are likely to be more risky, and those that have more income assets (such as fixed interest and cash) are likely to be less risky. |

Currency risk |

Some of the scheme’s investments are made in currencies other than New Zealand dollars. While currency fluctuations can affect returns positively, there is also a risk they can affect returns negatively. |

Liquidity risk |

This is the risk that the scheme may not be able to meet its monetary obligations in a timely manner. This would arise if we are unable to cash up investments in time to pay benefits to members or meet other financial obligations. |

Diversification

One of the advantages of saving with the scheme is that your savings are spread across many different investments across a range of asset classes. Different assets perform differently in different market conditions. For instance, fixed-interest investments such as bonds might produce solid returns at a time when shares are underperforming and vice versa. By spreading your investments across different asset classes, you can reduce the volatility of your overall portfolio while maintaining your expected return. This is referred to as asset diversification. The exposure to each investment class varies depending on which investment option(s) you choose.

More information

Visit the saving and investing section at sorted.org.nz for more information about investment terms and concepts.