Fees & tax / Ngā utu me te tāke

Fees

The return you get from an investment is only one side of the equation. Fees also affect investment performance. We keep a close eye on the scheme’s costs to make sure they are fair and reasonable. This survey of fees provides a useful comparison of fees charged by KiwiSaver and workplace savings schemes in New Zealand.

This table summarises the fees charged by PSS.

Fee |

What it covers |

Type of fee |

How it's paid |

|

Investment fees |

Fees charged by Mercer Investment Trusts New Zealand (MITNZ) and the underlying investment managers it uses to invest the scheme's assets. |

Percentage-based fees |

Reflected in the unit price |

|

Administration fees |

The general cost of running the scheme. |

Monthly dollar-based fee |

Paid from your employer's account if you receive employer contributions or from your member's account if you don't. |

|

Individual transaction fees |

The cost of processing transactions initiated by individual members. |

One-off dollar-based fees |

Deducted from your employer's account (or your member's account if you are a savings contributor). |

Investment and administration fees are set out in the annual financial statements.

Investment fees

Investment fees include the costs charged in respect of the scheme’s investment in MITNZ and the underlying investment managers MITNZ uses to invest the assets of the scheme. Investment management expenses are reflected in the unit price for each investment option.

Investment fees vary across options. The fees for Stable, for example, are lower than for High Growth. The most significant reason for this is the rate of investment fees in the underlying sectors that make up each option. For example, investment fees for international equities are much higher than for bonds or for cash. High Growth has the largest allocation to international equities, which is reflected in High Growth having the highest investment cost.

See the product disclosure statement for more information about these charges.

Estimated total annual fund charges

Option |

Fund charges (% of the net asset value of the fund per year) |

|

High Growth |

0.38% |

|

Growth |

0.38% |

|

Balanced |

0.35% |

|

Stable |

0.29% |

|

Cash Plus |

0.19% |

|

Super Steps (age 49) |

0.36% |

|

Super Steps (age 54) |

0.34% |

|

Super Steps (age 59) |

0.31% |

Estimated fund charges do not include trading expenses (such as brokerage fees and spreads). Fees updated 28 April 2025.

Administration fees

An administration fee is charged monthly based on the amount necessary to cover the cost of running the scheme. The administration fee is paid from your employer’s account if you receive employer contributions or from your member’s account if you don’t. The current fee is up to $5.50 per member per month.

Administration fees meet the cost of running the scheme. They cover a range of professional services, including secretarial services, audit, legal, investment advice, tax and actuarial advice professional directors’ fees and directors’ expenses. Administration fees also cover the cost of providing member services. These include things such as maintaining member and general scheme records, operating the member helpline and website and reporting to and communicating with members. See the product disclosure statement for more information about these fees.

Individual transaction fees

A transaction fee will be debited from your employer’s account (or your member’s account if you are a savings contributor) if you:

- change your investment option(s) more than once in any scheme year (1 April to 31 March)

- request a benefit quote

- are paid a benefit.

This includes leaving benefits, in-service and partial withdrawals, first-home withdrawals, age 65 withdrawals, significant financial hardship benefits and relationship property settlements. It also includes one-off partial withdrawals made by a retained member. There is no fee for regular monthly withdrawals by a retained member. There is also no fee in Super Steps when your account balances and contributions are changed automatically on 1 April (from age 45). If a registered charge is placed on your benefit, a fee will be debited from your member’s account. The annual account statement we send to you each year shows any amounts deducted from your accounts.

Individual transaction fees are as follows (updated 1 January 2025):

|

Benefit payment fee |

$86.23 per withdrawal |

|

Partial withdrawal fee (applies to withdrawals by active members and one-off withdrawals by retained members) |

$86.23 per withdrawal |

|

Registered charge fee |

$43.04 per registered charge |

|

First-home withdrawal fee |

$268.16 |

|

Benefit quotation fee (check your account balance for free at any time by signing in to your account) |

$10 per quotation |

|

Investment switch fee |

First switch each scheme year (1 April to 31 March): free |

Tax

Employer superannuation contribution tax

Employer superannuation contribution tax (ESCT) is deducted from employer contributions before they are credited to your employer’s account. The tax rate varies depending on the total amount of:

- your salary and wages in the prior tax year (or an estimate of your income for the current year if you have worked for Police for less than a year)

- employer contributions received during the previous year (or an estimate of those contributions for the current year if you have worked for Police for less than a year).

Salary and wages includes bonuses, overtime and other pay as well as parental payments and accommodation benefits.

ESCT is not applied in the same tiered way as personal income tax rates and only one rate applies to the total amount of the employer contribution.

ESCT rates

Taxable income plus employer contributions |

Tax rate (%) |

|

Up to $18,720 |

10.5 |

|

Between $18,721 and $64,200 |

17.5 |

|

Between $64,201 and $93,720 |

30.0 |

|

Between $93,721 and $216,000 |

33.0 |

|

$216,001 and over |

39.0 |

Tax on investment income

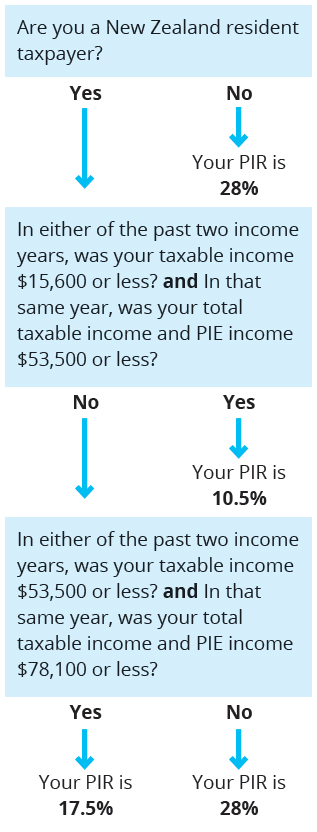

The scheme is registered as a multi-rate PIE. So, taxable income related to your investment in the scheme is taxed at your prescribed investor rate (PIR), which may differ from the personal income tax rate applied to your salary and wages, rather than at a flat rate for the whole scheme. The current PIRs for individuals are 10.5%, 17.5% and 28%. Your PIR is determined by your taxable income (your income subject to tax, including salary and wages) and your PIE attributed income (for example, taxable income attributed to you by managed fund investments that are multi-rate PIEs).

You are responsible for ensuring your PIR is correct. If you do not provide us with your PIR, the 28% default rate will apply. It is important that you check your PIR before 31 March every year (i.e. end of the scheme’s year) as after this date PIE tax on your share of the scheme’s taxable earnings will be paid.

If the PIR that Inland Revenue (IRD) calculates differs from the PIR provided to us, there may be PIE tax payable or a refundable PIE tax credit in your MyIR account. If you are concerned about a difference between the PIR used by IRD and the PIR used by the scheme, please give us a call or contact IRD.

Periodically, IRD requests that we update PIRs for members they consider have incorrect PIRs applied, and we are required to apply those updates. You should also receive notification of any such update. If you disagree with the updated PIR provided by IRD, you can contact IRD to explain why and have it corrected if applicable.

The diagram below can assist with determining your PIR. Alternatively, please refer to IRD's online tool. If your circumstances have changed and you may need to change your PIR, fill in a confirmation of tax rate (PIR) form to return to us.

Your PIR is 28% if you are not a New Zealand resident for tax purposes. Complete the change of tax residency status form if you need to change your tax residency status. If you are not sure of your residency status, visit this page on IRD's website or consult with a tax specialist.

Call us on 0800 777 243 if you have any questions about PIE income. For further information, see IRD’s website.